Is your flood insurance changing?

- Christian Kohler

- Jul 17, 2021

- 2 min read

FEMA (Federal emergency management agency) has just announced that there will be a change in the way flood insurance rates are processed and the rates in which consumers will pay for flood insurance. This new plan is being referred to as the risk rating 2.0 by FEMA.

What does this mean? Properties will now be assessed on their past flood damage to give a more accurate pricing to consumers. If your home is located in a flood zone but has never incurred damage from flood waters in the past your rates would be dramatically lower than a home located within a flood zone that has flooded every time a hurricane has made landfall in the area.

Are current policy holders grandfathered in?

The answer is YES!! Current policy holders will be allowed to continue with their policy and it is transferable to new purchasers. Now this may not be ideal to all policy holders as the new flood rating program could potentially drop rates for a home not considered as high risk for flooding. To check your home ans see if you are located in a flood zone click the link below.

When will the changes occur?

The new risk rating 2.0 will be rolled out in October of 2021 and available for use in helping to project potential rate pricing. New rates will not take place until April of 2022, so stay at ease for the current moment nothing will change right now!

What new home buyers should know?

You can have your agent check to see if a new home is located in a flood zone.

You can request a properties flood history to be provided by the seller during your due diligence period.

You can request a quote for flood insurance from a local agent.

Do not let the fact that a home is located in or near a flood zone scare you.

Flood rates may be more affordable that you think.

Quick facts about flood insurance

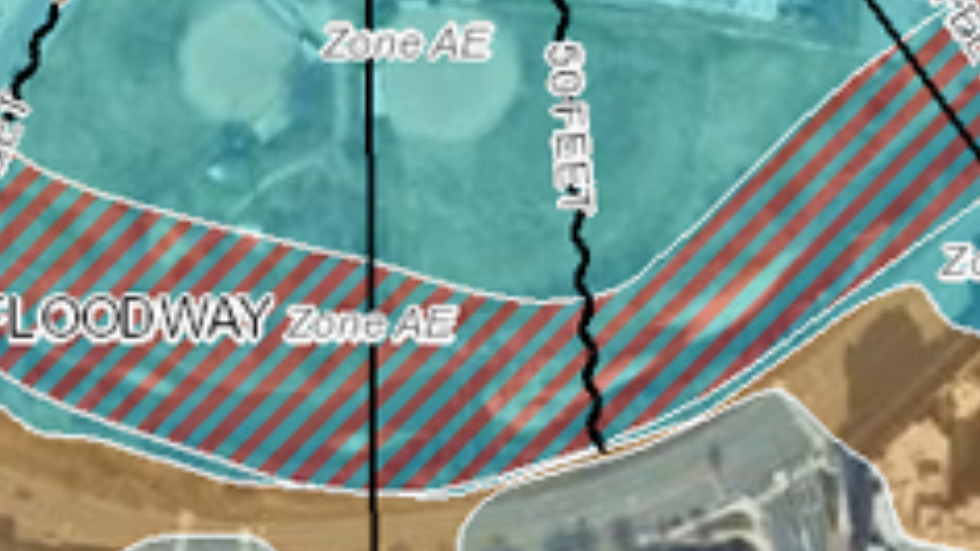

In high risk areas are specified on flood maps and are labeled starting with A or V. These high risk areas have a 1 in 4 chance of flooding in the 30 year term of your mortgage and lenders will require proof of flood insurance in order to lend on the property. Homes that are located in low risk or minimal flood zone are identified by letters B, C or X. Even though these areas are considered a moderate to low risk area they account for more than 20 percent of all flood claims in the USA each year. Even though flood insurance isn't federally required in these areas it is recommended that all property owners and renters in these areas still acquire flood insurance.

Comments